Hey Educators and Parents!

Are you ready to finally take control of your finances and invest for your future?

Then join me in my Level Up Your Finances program so you can take control of your financial future, make work optional, and use your money in a way that makes you feel fulfilled!

Not currently accepting students. Send me a message if you're interested in signing up!

Then join me in my Level Up Your Finances program so you can take control of your financial future, make work optional, and use your money in a way that makes you feel fulfilled!

Not currently accepting students. Send me a message if you're interested in signing up!

Level Up Your Finances

Write your awesome label here.

Does this sound like you?

You can conquer money and use it to achieve your goals, and you don't have to be a high earner to do it!

But I know you're a busy parent, with very little free time. And it sounds like such a huge task, and you have no idea where to start or who to ask. It feels impossible that you could ever really feel confident with money! You may even be feeling ashamed of some of your past or current money choices and are looking for a safe community where you can learn without judgement or shame.

And you have tried to...

Write your awesome label here.

I get it!

I didn't actually gain financial clarity until recently either.

As you can see from my investing chart, in 2015 I only had $500 invested! I was terrified to invest and didn't know where to go for reliable information. I knew that my partner and I wanted time freedom, we wanted to have meaningful experiences with our children, and we wanted to retire early. But we had no idea how to get there.

But I figured it out, and I reached my first investing goal! And so can you.

Who is behind this program?

Hi, I'm Michelle Onaka

I have a Bachelor of Arts in Economics and a Master of Science in College Student Services Administration (higher education). In my part-time day job, I am a TRIO SSS academic counselor at Oregon State University, helping first-generation and Pell-eligible college students get their degrees. I specialize in supporting people, helping them stay accountable to their goals, and working with them to strategize solutions for their individual situations. I also teach a college course called Planning Your Financial Future to help my students prepare for their financial lives after college. I created this program, Level Up Your Finances, to support parents in identifying, setting, and reaching their financial goals because I know how confusing it all can be.

Patrick Jones - Course author

Want proof?

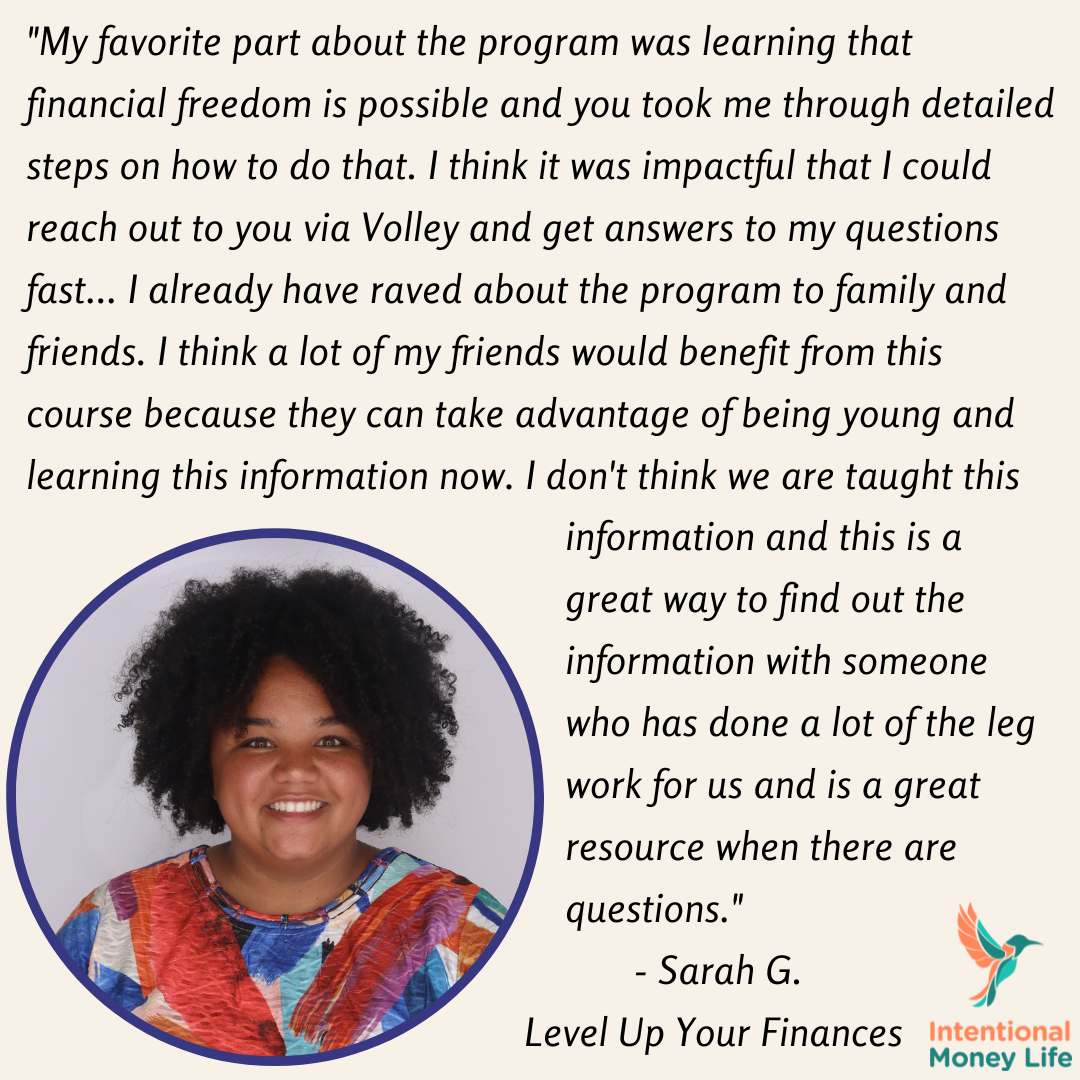

Each module includes a reflection space. This isn't meant to be a testimonial, just a space to reflect on the content and what students are learning. Here are some of those reflections:

"Usually I feel bored when I think about the nitty gritty of money and math, but because we are pairing empowering knowledge with specific goals in my life that actually do make me excited, (I can’t believe I am actually saying this) I am looking forward to digging in about the stock market."

Alicia S., Module 1

"I just have to say… I'm only halfway through module 2. But this is why I signed up for this course! This stuff was so mysterious to me before. So I've always been an awesome saver and not a good investor because I just didn't even know where to start. And I'm seriously so comforted by learning all of this stuff right now. I'm so excited!"

Jamie H., Module 2

"Retirement is a lot more attainable than I thought when I first started this module! I am glad I am getting into this now that I am only 30 years old and have time on my side. I feel a lot less discouraged and hopeless about retirement... I feel like I have a plan!"

Anna B., Module 5

If you’re ready to take control of your finances and create the life that you want for yourself and your family, then it’s time to join Level Up Your Finances! Remember that the longer you wait, the less compound interest can benefit you in the long run!

What's included?

-

8 Video-based modules

-

Workbook with activities and cheat sheets

-

Personalized 1:1 support throughout program

-

Audio-only podcast feed for on the go listening

-

Certificate of Completion

Learn about yourself

Do you know what you really care about? What a life that you love actually looks like? Have you ever figured out what your values are, and then specifically figured out how they relate to money?

Really understanding yourself is the first key to putting your money to work creating a life that you love, so we'll start there!

Really understanding yourself is the first key to putting your money to work creating a life that you love, so we'll start there!

Financial knowledge + application

We'll learn about compound interest, how the stock market works (and why you don't have to be scared of it), all about taxes and how to be more tax-efficient, how to figure out an initial retirement goal number, the nitty gritty of investing, and so much more.

With everything you learn, you will complete step by step activities to apply the information to your own life so you can put your new knowledge to work. And you will receive 1:1 support and accountability to keep you on track!

With everything you learn, you will complete step by step activities to apply the information to your own life so you can put your new knowledge to work. And you will receive 1:1 support and accountability to keep you on track!

What does the personalized support look like?

Asynchronous support

We'll use an app to communicate with each other. Through this app, we'll be able to send audio messages, pictures, and text-based messages back and forth, which will allow me to answer your questions regularly and often so you can keep moving forward.

Workbook Feedback

You'll have the option to use Google Docs for your workbook, where you can share the workbook with me and tag me when you're wanting feedback. I'll be able to see where you are and what you're thinking about, answer questions, point out things you might want to be aware of, clarify concepts that you're confused about, and generally encourage you as you apply everything we learn to your own situation.

Live 1:1 meetings

Sometimes it'll be far faster to just get on a call, share your screen, and talk about things in real time. That's why I offer live 1:1 meetings, where we could review your taxes, go through your work-related retirement accounts, change your investments, or discuss any of the other concepts or actions you might want to be taking.

Bonus!

Sign me up!

Frequently asked questions

What is the time commitment?

3-6 hours per module (8 total modules) is a reasonable expectation, though some people fly through it in less time and some spend more time. That time consists of watching 30-60 minutes of videos (for the first 7 of 8 modules), completing 2-5 activities where you apply the information to your own life, and bringing any questions or reflections to me (Michelle). Module 8 doesn't have any videos, it just has one activity where you go back through the entire workbook and everything you have learned, and identify the next steps that you'll take.

How long will the program last/how long will I have access to the program material and support?

You will download the workbook to keep for yourself. You will have access to the course videos for as long as I continue offering the program through this website (at least). You will have access to one on one support related to the program content for 3 months after you join the program, and you can always extend that support for $95/month.

How does the personalized support work?

I provide support in multiple ways, including:

- We will use an app that allows us to privately share audio messages, text, and pictures back and forth, allowing you to get personalized support asynchronously.

- You can share your Google workbook with me so that I can give you personalized feedback and answer your questions as you work through the program.

- We can meet live to look through something together (your taxes, your retirement investments at work, etc.) as needed. I would encourage everyone to do at least one live one on one meeting at the end of the program!

- You can always join my free Facebook group and post on there, where you can get answers from me and possibly others.

How do I know if this program is for me?

This program is especially for educators and parents of young children who already have decent credit and don't have significant consumer debt (or already have a plan to pay it off). You do NOT have to be an educator or a parent though, so if everything else looks good to you and you're in a place to re-evaluate and level up your finances, by all means, please join! This is a comprehensive educational program, covering investing, taxes, and retirement planning. If you feel you're lacking education in these areas and you're ready to jump in and learn more, while always applying that info to your life, then this program is for you!

What if I want to do this with my partner?

Awesome! I strongly encourage partners to work together on their financial situations. Once one partner purchases the program, they can email me at Michelle@intentionalmoneylife.com and send me their partner's name, phone number, and email address and I can get them added to the program website so they have their own login and can get their own workbook, can watch the videos, etc. If they also want personalized support, they can let me know and we can get them subscribed to the monthly support for a heavily reduced price of $30/month, which they can cancel whenever they no longer need the support.

Will you blame or shame me? Will you tell me what to do?

I strongly believe in social justice and in understanding the impact of systems of oppression. I do not shame and blame people for their situations, and I will never try to tell you what you should do. I believe you need reliable information and support in making sure you understand that information and any potential ramifications of your decisions, and then you should feel confident making your own decisions.

Everyone is trying to sell me something, how do I know that I can trust you?

Besides purchasing the program (and an occasional affiliate link that will always be clearly labeled), I will not make money off of anything that you do because of the program. I will not make money when you invest, or file your taxes, or buy insurance. I have no incentive to give you bad information. Note that I am not a licensed financial professional and the information I provide is for educational purposes only and not given as advice. But I have spent the past couple years learning everything that I could, always seeking evidence-based information, as I needed this information to make my own decisions. If I don't know the answers you seek, I will either help you figure them out or refer you to someone who can help you. If you'd like to see some of my work, check out my blog, such as this post where I explain why you really want to avoid fees when investing.

This sounds like a pretty big commitment. What if I'm not ready?

If you're just feeling overwhelmed with the idea of everything that we'll cover, just remember that I'll be with you. I will be there to answer your questions, talk about your struggles, etc. And you can go at your own pace. For some people, they will fly through the program in 8 weeks or less. Others might want to take more like 6 months or even longer. It's totally up to you, and it's all broken down into small pieces, where you watch a video or a couple, then do an activity where you apply it. You can always take breaks between the topics or modules!

If you truly are not ready for this but want to get started with something, consider my Money Goals Clarity mini-course instead. It covers some of the initial pieces of this course, and also includes 1:1 support and accountability. It's a great place to get started.

That being said, remember that with compound interest, the sooner you start investing the more you'll have in the end. So even if this isn't the perfect time for you to commit to this program, if you are financially in the right place to take it (you don't have credit card debt, you have at least some emergency fund, and things like that), I'd encourage you to make the time for it. It will pay off in the long run! And there are various payment options, with 1 option that includes support for 12 months, so you would have plenty of time to get through it!

If you truly are not ready for this but want to get started with something, consider my Money Goals Clarity mini-course instead. It covers some of the initial pieces of this course, and also includes 1:1 support and accountability. It's a great place to get started.

That being said, remember that with compound interest, the sooner you start investing the more you'll have in the end. So even if this isn't the perfect time for you to commit to this program, if you are financially in the right place to take it (you don't have credit card debt, you have at least some emergency fund, and things like that), I'd encourage you to make the time for it. It will pay off in the long run! And there are various payment options, with 1 option that includes support for 12 months, so you would have plenty of time to get through it!

I'm interested, but I can't afford it right now! What can I do?

There are many options to be able to join the program even if you don't have the money to pay for it just sitting in savings. One option would be the payment plan, which spreads the payment over 3 months. Another option would be to pay through PayPal and see which payment options come up for you. One student used PayPal Pay Later to reduce her up front payment, and I personally have used PayPal Credit where I had 6 months from the purchase date to pay it off interest free. It's at least worth checking into!

If a payment plan would not be enough to help you afford this, but you'd really, really like to join, send me an email (Michelle@intentionalmoneylife.com). Maybe we can work something out!

If a payment plan would not be enough to help you afford this, but you'd really, really like to join, send me an email (Michelle@intentionalmoneylife.com). Maybe we can work something out!

Do you have another question that I didn't answer?

Feel free to send me an email with any other questions at Michelle@intentionalmoneylife.com. I'd be happy to either respond via email, or get on the phone and answer any questions you have!

Let's do this!

Write your awesome label here.